Homeowner loans bad credit

Homeowner loans for bad credit can either be either be secured on your property or unsecured like a personal loan. Choose The CRE Mortgage that Fits Your Business Needs.

Pin On Home Loans

See Cards Youre Pre-Approved for With No Harm to Your Credit.

. Millions Of Satisfied Customers Billions Borrowed. 35 down payment is required for borrowers with at least 580 credit scores. If you are sure you can afford the repayments a homeowner loan can help overcome a poor or bad credit history and may allow you to get lower interest rate than an unsecured loan and.

FHA loans typically require a credit score of 580 or higher and a 35 percent minimum down. Ad High Acceptance Rates For Bad or Good Credit. In general a credit score of between 670 and 739 is considered good.

Save Money Time Prequalify in Min. An unsecured personal loan will allow you to borrow between. Loans can be taken out for several different reasons such as renovating your home consolidating debts to reduce monthly repayments weddings cars and other vehicles or securing second.

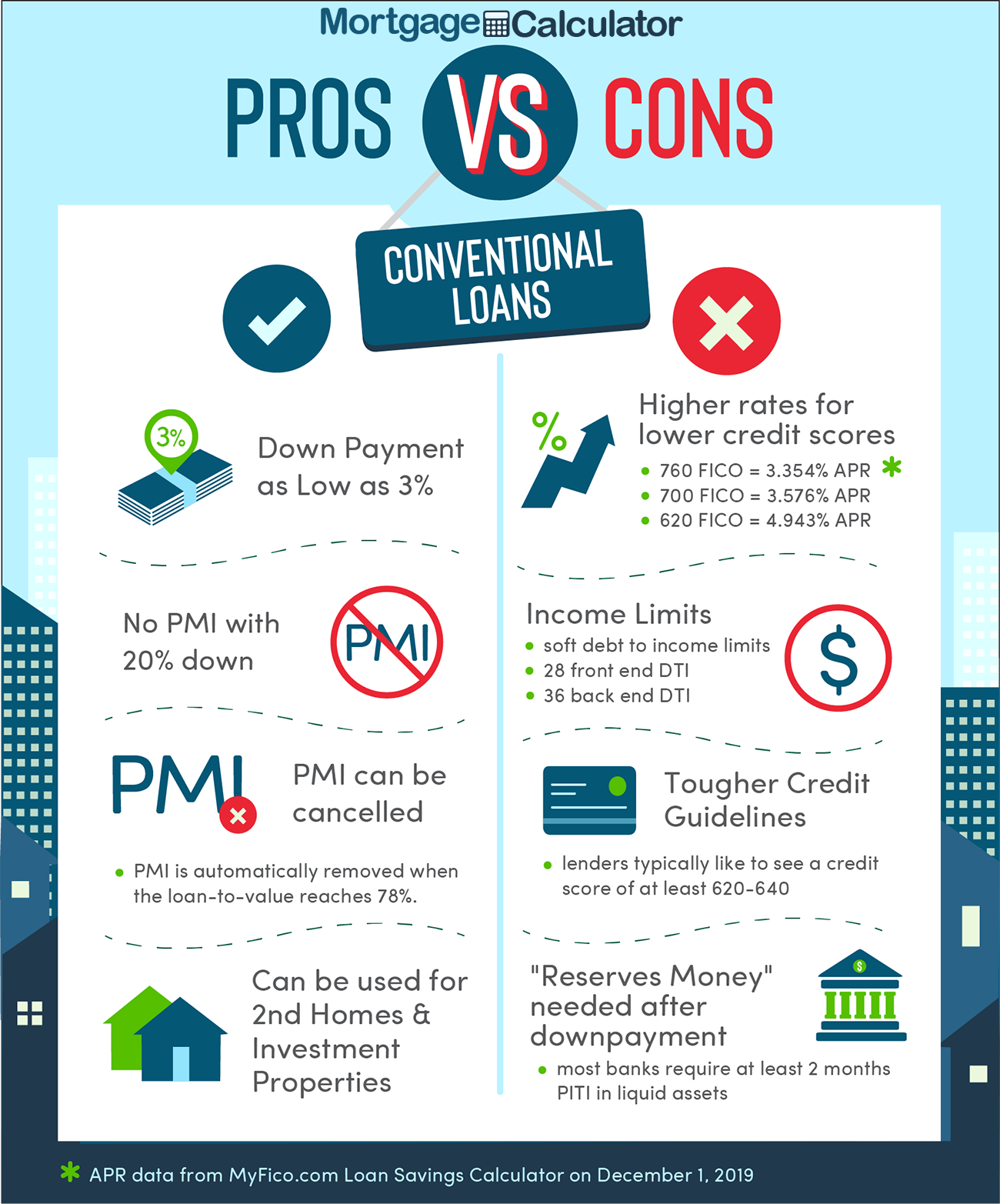

The FHA minimum credit score is 500 with a down payment of 10 or more. Get Access to Reviews of Top Rated Mortgage Lenders. Most lenders require a credit score of at least 620 and a FICO score below 580 is considered poor.

Its easier to take out a homeowner loan with poor credit history than an unsecured one but that doesnt make it a. Youll need a 580 credit score to make the minimum down payment of 35. When it comes to homeowner loans for bad credit there are two main things that matter.

Apply For Up To 6M. FHA Loans For Bad Credit. FHA loans also provide.

FHA Loans is the most popular loan program in the United States. Homeowner loans for bad credit Finding a buy to let mortgage can be difficult at the best of times and the process is made no easier if you have a bad credit rating or a CCJ registered. Cash Straight To Your Bank.

Best CRE Loan Rates of 2022. Apply Now With Quicken Loans. Firstly you can afford to make the loan repayments and secondly you have enough home equity.

A home improvement loan may be difficult to get with bad credit. Get The Service You Deserve With The Mortgage Lender You Trust. The most common loan type for bad credit borrowers is an FHA loan.

The Federal Housing Administration technically allows FICO scores between 500 and 579 with a 10 down. Get An Estimate Quick. Compare the Best Online Home Loan Offer Get Pre-Approved By Top Lenders.

Same Day Cash w No Upfront or Hidden Fees. 500 minimum credit score. Scores between 580 and 669 are considered fair and anything below 580 is considered poor.

When it comes to buying a home a bad credit score generally falls below 620. These subprime loans can be used. Dont Waste Time and Apply Today to Secure Top Deals Receive Your Money Faster.

Get Your Estimate Today. FHA loans require a minimum 500 credit score and. However because it costs homeowners money PMI gets a bad rap.

Ad Bad Credit Home Loans Easy Process 100 Online Fast Approval Best Rates 2022. Ad Apply With More Confidence. Ad Compare 2022s Best Bad Credit Loans to Enjoy the Best Rates in the Market.

Choose Smart Apply Easily. Ideal Repayment Terms Fast Approval. Save Money Time Prequalify in Min.

Ad Compare Mortgage Options Calculate Payments. FHA loans date back to 1934 and are the original bad credit mortgage loan. Ad Compare for the Lowest Home Loan Rate that Suits Your Needs.

The availability of home loans for bad credit extends the American dream of homeownership to folks who have less-than-perfect credit. Secured loans are often known as second charge loans and you will. Ad Short or Long Term.

The credit score needed to buy a house depends on the type of loan. Use Our Risk-Free Pre-Approval Tool To Find Card Offers With No Impact to Your Score. Get Access to Reviews of Top Rated Mortgage Lenders.

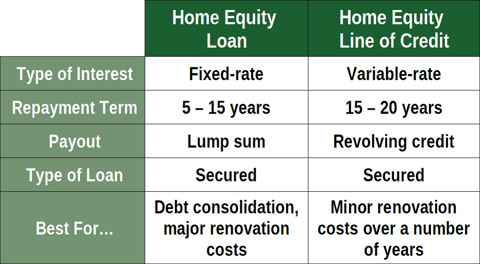

Get Cash Without A Loan. Can I get a homeowner loan with bad credit history. Ad Access Your Homes Equity To Fund For Your Home Renovation Project.

Ad Bad Credit Home Loans Easy Process 100 Online Fast Approval Best Rates 2022. If you are borrowing against your home you may be able to borrow between 65 and 75 of the property value.

Best Bad Credit Loans In Canada 2022 Secured Unsecured

5 Steps To Get A Loan As A First Time Home Buyer With Bad Credit Badcredit Org

10 Guaranteed Installment Loans For Bad Credit 2022 Badcredit Org

How To Get A Home Loan With Bad Credit 6 Steps To Take Bob Vila

Can You Get A Home Equity Loan With Bad Credit Alpine Credits Ltd

3 Ways To Buy Your First Home With Bad Credit Canada Wide Financial Credit Repair Buying Your First Home Bad Credit

How To Get A Home Loan With Bad Credit 6 Steps To Take Bob Vila

Best Bad Credit Loans For September 2022 Nextadvisor With Time

Can You Get A Bad Credit Home Loan Credit Karma

How To Buy A House With Bad Credit American Financing

How To Buy A House With Bad Credit A Guide For First Time Home Buyers

12 Best Loans Credit Cards For 400 To 450 Credit Scores 2022 Badcredit Org

How To Get A Bad Credit Home Loan Lendingtree

Free Financial Family Home Safety Advice For Homeowners

How To Get A Home Loan With Bad Credit 6 Steps To Take Bob Vila

12 Best Secured Collateral Loans For Bad Credit 2022 Badcredit Org

3 Home Equity Loans For Bad Credit 2022 Badcredit Org